A ledger statement is a comprehensive financial record that shows the detailed history of transactions related to a specific account or ledger over a given period. It serves as a detailed accounting document used to track the inflows and outflows of money, assets, or liabilities.

How can you view Ledger Statement in Classunify Institute Management ERP:

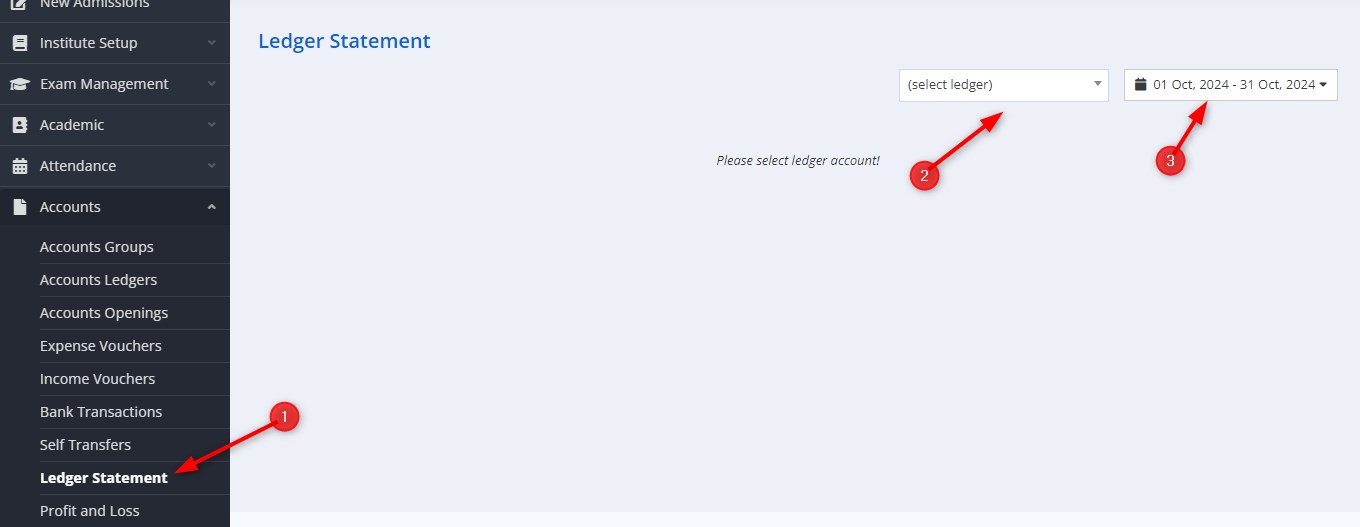

To view ledger statement, follow the steps:

1. From the side menu bar, click on Accounts > Ledger Statement > Select Ledger and Date.

2.The image displays a Ledger Statement for Tuition Fees between 01 February 2024 and 01 October 2024. You can also print the ledger statement by clicking on the Print button on the top left corner.

Below is a detailed explanation of each section and table cell:

Ledger Information (Top section)

Ledger Name: The name of the account being tracked is Tuition Fees.

Opening Balance: As of 01-02-2024, the opening balance is Rs. 0. This means the account started with no balance.

Closing Balance: As of 01-10-2024, the closing balance is Rs. 1,51,050. This is the total balance after all transactions have been recorded.

Phone No, GSTIN, Address: These fields are empty but could be filled with details related to the account holder or entity.

Transaction Table (Detailed breakdown of each column)

Date: The date of each transaction, such as:01-02-2024, 05-02-2024, 11-03-2024, etc.

Description: A brief note of the transaction type, primarily receipts in this case. For example:

Receipt No. 76

Receipt No. 77

Receipt No. 156, etc.

Ref No./Cheque No.: The reference or cheque number for each receipt, providing an identifier for each transaction:

Receipt No. 76

Receipt No. 77

Receipt No. 156, etc.

From/To: The name of the individual or entity associated with the transaction. In this case, individuals paying tuition fees are listed:

Soumyajit Kar

Atanu Sen

Subhamita Basak, etc.

Debit: The amount deducted from the account. In this ledger, there are no debits as the transactions are all credits (income/fees collection).

Credit: The amount credited (added) to the account, showing tuition fees received. Examples:

Rs. 2,400

Rs. 500

Rs. 4,200, etc.

Balance: The running balance after each transaction, which accumulates as the credits are added. For example:

After the first transaction, the balance is Rs. 2,400.

After subsequent transactions, the balance grows, e.g., Rs. 10,100, Rs. 14,100, etc.

This ledger tracks tuition fees collected over the period, displaying individual receipts from various students.The balance increases as credits (payments) are made, and the statement concludes with a closing balance of Rs. 1,51,050.